As opposed to an income statement which reports financial information over a period of time, a balance sheet is used to determine the health of a company on a specific day. The financial statement only captures the financial position of a company on a specific day. Looking at a single balance sheet by itself may make it difficult to extract whether a company is performing well. For example, imagine a company reports $1,000,000 of cash on hand at the end of the month. Without context, a comparative point, knowledge of its previous cash balance, and an understanding of industry operating demands, knowing how much cash on hand a company has yields limited value.

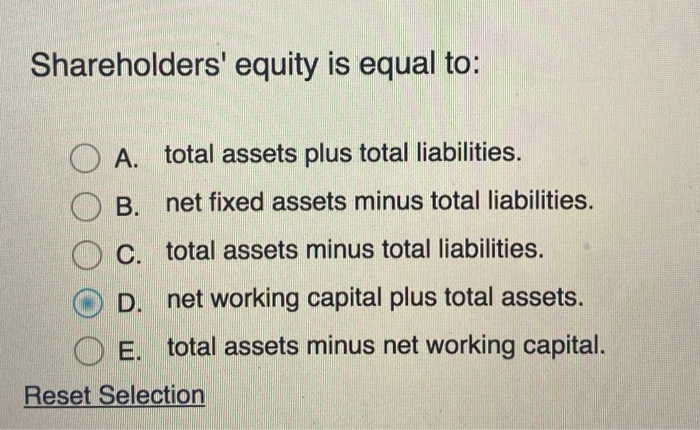

What Is Shareholders’ Equity in the Accounting Equation?

Along with Equity, they make up the other side of the Accounting Equation. It can be sold at a later date to raise cash or reserved to repel a hostile takeover. There are a few common components that investors are likely to come across. Our easy online application is free, and no special documentation is required. All participants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program.

Owners’ Equity

When analyzed over time or comparatively against competing companies, managers can better understand ways to improve the financial health of a company. Because the value of liabilities is constant, all changes to assets must be reflected with a change in equity. This is also why all revenue and expense accounts are equity accounts, because they represent changes to the value of assets. If the net amount is a negative amount, it is referred to as a net loss.

Do you own a business?

For a more specific breakdown of the components of equity, use the expanded equation instead. The expanded accounting equation is derived from the common accounting equation and illustrates in greater detail the different components of stockholders’ equity in a company. The claims to the assets owned by a business entity are primarily divided into two types – the claims of creditors and the claims of owner of the business. In accounting, the claims of creditors are referred to as liabilities and the claims of owner are referred to as owner’s equity. The Accounting Equation is a fundamental principle that states assets must equal the sum of liabilities and shareholders equity at all times. A balance sheet explains the financial position of a company at a specific point in time.

How Does the Double Entry Accounting System Work?

In the basic accounting equation, assets are equal to liabilities plus equity. For all recorded transactions, if the total debits and credits for a transaction are equal, then the result is that the company’s assets are equal to the sum of its liabilities and equity. The balance sheet is one of the three main financial statements that depicts a company’s assets, liabilities, and equity sections at a specific point in time (i.e. a “snapshot”). Understanding and analyzing key financial statements like the balance sheet, income statement, and cash flow statement is critical to painting a clear picture of a business’s past, present, and future performance.

- The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet.

- The expanded accounting equation is a form of the basic accounting equation that includes the distinct components of owner’s equity, such as dividends, shareholder capital, revenue, and expenses.

- The image below is an example of a comparative balance sheet of Apple, Inc.

If an accounting equation does not balance, it means that the accounting transactions are not properly recorded. An asset can be cash or something that has monetary value such as inventory, furniture, equipment etc. while liabilities are debts that need to be paid in the future. For example, if you have a house then that is an asset for you but it is also a liability because it needs to be paid off in the future.

By decomposing equity into component parts, analysts can get a better idea of how profits are being used—as dividends, reinvested into the company, or retained as cash. By looking at the sample balance sheet below, you can extract vital information about the health of the company being reported on. External auditors, on the other hand, might use a balance sheet to ensure a company is complying with any reporting laws it’s subject to. By using the above calculation, one can calculate the total asset of a company at any point in time. Ltd has below balance sheet for 5 years, i.e., from the year 2014 to 2018.

The liabilities section is broken out similarly as the assets section, with current liabilities and non-current liabilities reporting balances by account. The total shareholder’s equity section reports common stock value, retained earnings, and accumulated other comprehensive income. Apple’s total liabilities increased, total equity decreased, and the combination of the two reconcile to the company’s total assets. The assets on the balance sheet consist of what a company owns or will receive in the future and which are measurable. Liabilities are what a company owes, such as taxes, payables, salaries, and debt. The shareholders’ equity section displays the company’s retained earnings and the capital that has been contributed by shareholders.

This includes expense reports, cash flow and salary and company investments. Under the accrual basis of accounting, expenses are matched with revenues on the income statement when the expenses expire or title has transferred to the buyer, rather than at the time when expenses are paid. The balance sheet reports services the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such as December 31. The balance sheet is also referred to as the Statement of Financial Position. For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts.

Shareholders’ equity is the total value of the company expressed in dollars. Put another way, it is the amount that would remain if the company liquidated all of its assets and paid off all of its debts. The remainder is the shareholders’ equity, which would be returned to them. At the bottom of the balance sheet, we can see that total liabilities and shareholders’ equity are added together to come up with $375,319 billion which balances with Apple’s total assets. Substituting for the appropriate terms of the expanded accounting equation, these figures add up to the total declared assets for Apple, Inc., which are worth $329,840 million U.S. dollars. The asset equals the sum of all assets, i.e., cash, accounts receivable, prepaid expense, and inventory, i.e., $234,762 for 2014.

ΚΟΙΝΟΠΟΙΗΣΤΕ